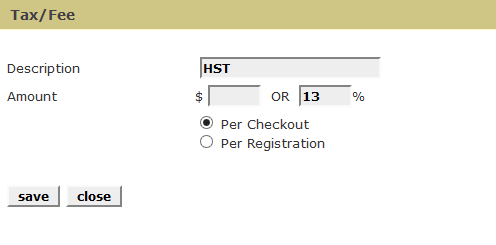

The usual function for this field would be to add taxes as are prevalent in countries such as Canada. Canada has several service tax requirements, depending on which province an event is held.

The above example shows how a Harmonized Sales Tax would be added to registrations for an event in Ontario.

You may add as many Tax/Fee entries as you wish.

If the charge is a currency amount ($), you may elect to charge that amount on a per registration basis or for a combined (per checkout). A percentage charge always applies to a checkout - i.e. for the total charges.

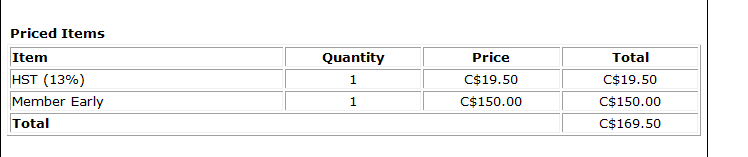

This is how the tax looks on a registrant invoice:

Service fees, if charged on a percentage basis are not charged on taxes and fees.

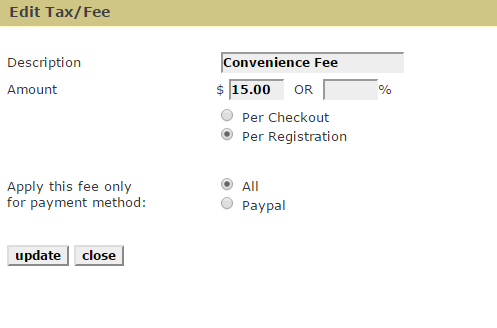

You can also use this option to charge a service fee:

The fee option is similar to a tax, but it can be conditioned on whether the registrant is using Paypal or a credit card. Paypal usually charges about 3% of the amount paid via Paypal, so you could assess a 3% fee on registrants who use Paypal or a credit card. Note that if you use credit cards via a merchant account you will also see a Credit card button.

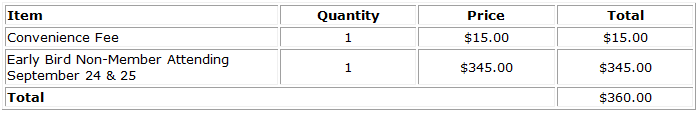

The above fee would be displayed on the registrants confirmation like this:

If you are going to bundle the service fee in your own fee, be sure to turn off the separate service fee radio button immediately above the taxes/fees area on the Extras page.